2025 Emerging Market Fixed Income Outlook: Trending Up Despite Trade Uncertainty

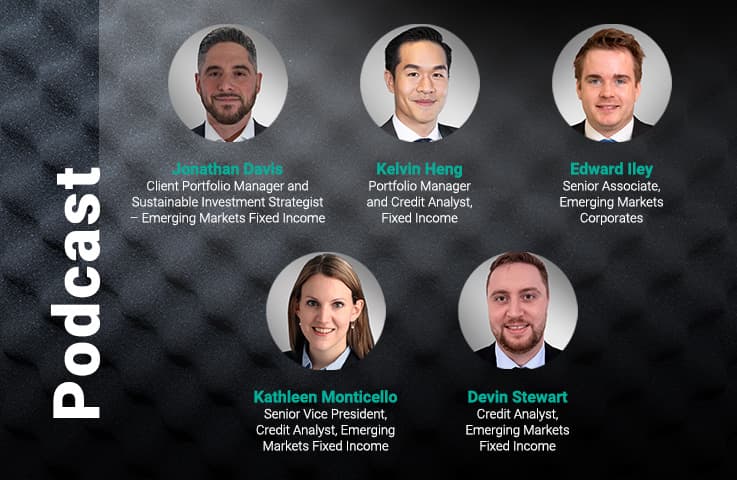

Jonathan Davis

Client Portfolio Manager and Sustainable Investment Strategist – Emerging Markets Fixed Income

Kathleen Monticello

Senior Vice President, Credit Analyst, Emerging Markets Fixed Income

Kevin Chow

Credit Analyst, Fixed Income

Alfonso de la Torre

Sovereign Analyst, Emerging Markets Fixed Income

Devin Stewart

Credit Analyst, Emerging Markets Fixed Income

Agustin Bonasora, CFA

Corporate Analyst, Emerging Markets Fixed Income

Emerging markets boast a strong fundamental backdrop as we enter 2025: Faster economic growth, stable inflation, improving account balances, and low debt levels and default rates should all contribute to positive ratings migration for both sovereign and corporate bond issuers this year.

But the months ahead also bring sources of potential volatility, none watched more closely than the second Trump administration’s trade policies. After campaigning on promises of an “America First” trade stance, President Trump’s opening moves are likely to cause market volatility for emerging market (EM) assets.

Nevertheless, emerging markets are a diverse group of countries, and a closer analysis at the local level gives us confidence in the positive credit trajectory across EM.

Tariffs under Trump 2.0

As a presidential candidate, Donald Trump threatened a 60% tariff on China and a 10% universal tariff on all US imports. He has since floated additional tariffs as a means of achieving a variety of geopolitical objectives. What can we expect from President Trump in his second term?

A look back to the first Trump administration can provide an idea of how trade policy might change over the next four years. The ultimate level of tariffs under Trump 1.0 fell short of initial headlines, as negotiated exceptions reduced the average rate. We expect a similar product-by-product approach this time, with certain goods hit with higher tariffs while others maintain exemptions. This would ultimately result in effective tariff rates that are well below the threatened 60% on China and the 10% universal tariff.

Tariffs could lead to weaker US demand and have a negative impact on GDP growth in the US and its major trading partners. While tariffs do have an inflationary effect, it is typically temporary and partly offset by ongoing disinflation of key services, such as shelter. Foreign exchange depreciation can also lessen the price impact of tariffs and make service exports even more attractive relative to merchandise goods. And trade diversion is not a universal negative, with certain countries’ share of global supply chains likely to grow, as was the case during the first Trump administration.

Where tariffs will hit hardest: Mexico and China

EM countries fall into three groups when it comes to US trade policy: Mexico, China, and everywhere else. During the first Trump administration, Mexico was one of the biggest beneficiaries of tariffs on China, as Mexico’s share of US imports rose and foreign investment increased. As the US’ top trading partner, Mexico is set to be a primary target of Trump’s trade policies, and the mention of a 25% tariff on Mexico contingent on border security concessions suggests a more difficult renegotiation of the United States-Mexico-Canada Agreement (USMCA) in 2026. Exports to the US represent nearly 80% of Mexico’s total exports, making the country particularly vulnerable to US tariffs (see chart below).

China holds the second-largest share of US imports and is likely to be President Trump’s top tariff target, with threats of a 60% flat tariff on all Chinese imports. While China is far less dependent on US exports than Mexico, tariffs of that magnitude could reduce the country’s GDP growth by 1% to 2%. However, though certain imports may see tariffs reach 60%, we expect a more transactional, product-by-product approach that will ultimately increase the average tariff rate to the mid-30% area. While this could reduce China’s GDP growth by 0.5% to 1.0%, we would expect the ultimate impact to be offset by a weaker yuan along with policy stimulus to ensure GDP growth of around 4.5% in 2025.

EM Countries’ Share of US Imports and the US Share of Exports

Source: Macrobond and as of 30 November 2024. Past performance, or any prediction, projection, or forecast, is not indicative of future performance.

Outside of Mexico and China, the remaining emerging market countries account for small shares of US imports, making them less of a target. While there could be material impacts on specific companies, we’re more focused on the secondary impacts of tariff-related macroeconomic changes for the rest of EM. China is now a more significant export destination than the US, so the extent to which tariffs reduce Chinese growth and thus demand will affect emerging markets. US tariffs on European imports would add to an already uncertain economic outlook and raise risks for emerging market countries that count on European demand.

The macroeconomic impacts of tariffs on emerging markets are not entirely negative. Trade diversion will help certain countries increase their share within global supply chains, particularly those that manufacture goods similar to Chinese products, as happened during the first Trump administration.

EM debt investment risks and opportunities in 2025

To fully understand the risks and potential investment opportunities created by US tariffs, we rely on our network of global research analysts, which contribute in-depth local expertise to our global perspective.

Given its geographic proximity to the US, Latin America has stronger economic links and a longer list of corporate bond issuers with US revenue (see chart). While US revenues are meaningful, many Latin America-based corporates with US revenues also have US operations.

Looking across Latin America’s bond markets, we believe the Mexican automotive industry faces elevated risk, as protecting US auto manufacturing will likely be a focus of tariffs. Auto parts manufacturers will deal not only with uncertainty related to tariffs but also changes to US policy regarding electric vehicles (EVs), which have been a key source of demand. These are known risks, however, and many companies have focused on balance sheet preservation to prepare for slower EV demand. Food and beverage companies also generate a meaningful portion of revenue from the US, but most of those companies have US production capacity.

In commodities, tariffs will likely subdue global demand and have a negative effect on prices. However, commodity producers also stand to benefit from potential complementary foreign exchange moves, as weaker local currencies will reduce operating costs relative to strong US dollar revenue.

Industrial sectors in Latin America that compete with Chinese producers for US demand will become even more competitive as tariffs are imposed on imports from China.

Latin America Has Close Economic and Trade Links to the US

LatAm revenues from the US per industry

LatAm exports to the US per industry

Source: J.P. Morgan CEMBI Broad Diversified Index as of 31 October 2024. Past performance, or any prediction, projection, or forecast, is not indicative of future performance.

In Asia, the direct impact of US tariffs will be limited, as less than 5% of issuers in the US dollar bond market have more than 20% of revenues tied to US exports. Whereas Latin America’s auto industry screens as one of the riskier sectors, Asian auto companies already have a high level of US production, which will not be subject to import tariffs. Asian battery manufacturers also have US operations but will face a potential decline in demand if tax credits for electric vehicles are withdrawn.

We do see risks to Asia’s technology sector, for which US sales represent a meaningful share of revenues. However, most hardware companies have diversified production capacity, both within Asia and in some cases globally. The US is also a substantial market for semiconductors, though we expect tariffs on semis to be limited because demand is high and supply is relatively inelastic.

While US tariffs will not directly affect much of Asia’s bond market, the impact on China’s economic growth will have implications across the region – but not exclusively negative, as more expensive imports from China may be rerouted to other producers within the region.

Asian Bond Issuers Have Limited Exposure to US Revenue

Source: J.P. Morgan JACI Composite Total Return Index as of 31 October 2024. Past performance, or any prediction, projection, or forecast, is not indicative of future performance.

Tariffs will not have a direct impact on eastern Europe, the Middle East, or Africa, where exports to the US are not a significant source of revenue. The more tangible risk is that US tariffs may constrain economic growth in western Europe, which is a much larger export market for industries in the region. Exports to western Europe could also face increased competition from Chinese suppliers rerouting exports from the US toward Europe. While slower global growth could cause energy prices to slide, supply risks in the global oil market would likely provide price stability. Several petrochemical companies in the region have US operations and could benefit from increased US demand as Chinese supplies become more costly.

EM credit trends should hold steady despite US trade moves

Addressing the US trade deficit is clearly a priority for the second Trump administration (as it was in the first), though many policy details are not yet known. We have yet to see much change in guidance across emerging markets as a result of potential shifts in US trade policy, but we expect more detail in planning and forecasts to accompany upcoming quarterly results.

While new tariffs may be imposed, US trade restrictions are not new, and emerging markets have adapted to changing trade dynamics arising from tariffs during the first Trump administration. We view the threat of tariffs as a tool to achieve more reciprocal trade relationships and a tactic to narrow US trade deficits. As was the case eight years ago, the opening volleys of trade negotiation will likely feature the starkest outcomes, and as such, markets may react poorly to the higher perceived risk.

Ultimately, we think the impact of US tariffs will be limited within the EM bond market and that the macroeconomic effects will not derail the positive trajectory of credit trends across emerging markets. As such, we view market volatility as an opportunity to obtain better prices for attractive assets. However, we believe credit differentiation remains critical, as risks within emerging markets – while limited – are still real.

Disclosure

Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. It represents a general assessment of the markets at a specific time and is not a guarantee of future performance results or market movement. This material does not constitute investment, financial, legal, tax, or other advice; investment research or a product of any research department; an offer to sell, or the solicitation of an offer to purchase any security or interest in a fund; or a recommendation for any investment product or strategy. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. Views may be based on third-party data that has not been independently verified. PineBridge Investments does not approve of or endorse any republication of this material. You are solely responsible for deciding whether any investment product or strategy is appropriate for you based upon your investment goals, financial situation and tolerance for risk.