‘Alternative’ Views: The Case for a Mid-Market Focus and Lessons Learned Along the Way (Part 2)

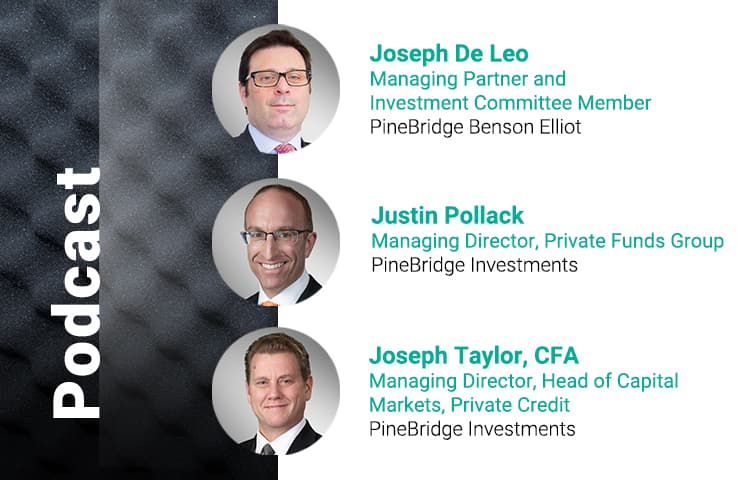

Joseph De Leo

Managing Partner and Investment Committee Member, PineBridge Benson Elliot

Joseph Taylor, CFA

Managing Director, Head of Capital Markets

A focus on the middle market is a common thread across PineBridge’s alternative strategies. Our seasoned investment specialists across European real estate, private credit, and private equity discuss the distinct opportunities and challenges of this market segment and why niche specialization, deep industry knowledge, and lessons learned from weathering crises can create value and drive outcomes. Join members of our alternatives platform as they discuss their collective middle market focus in our second episode of ‘Alternative’ Views.

Disclosure

Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. It represents a general assessment of the markets at a specific time and is not a guarantee of future performance results or market movement. This material does not constitute investment, financial, legal, tax, or other advice; investment research or a product of any research department; an offer to sell, or the solicitation of an offer to purchase any security or interest in a fund; or a recommendation for any investment product or strategy. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. Views may be based on third-party data that has not been independently verified. PineBridge Investments does not approve of or endorse any republication of this material. You are solely responsible for deciding whether any investment product or strategy is appropriate for you based upon your investment goals, financial situation and tolerance for risk.