Blurring the Line Between ‘Emerging’ and ‘Developed’ Asia: Investing in Asia Pacific Investment Grade Bonds

Omar Slim, CFA

Co-Head of Asia Fixed Income

Andy Suen, CFA, FRM

Co-Head of Asia Fixed Income

When investing in Asia bonds, also look to Japan and Australia to bolster returns and liquidity.

Adding APAC investment grade (IG) bonds to a global IG portfolio potentially enhances risk-adjusted returns.

Policy normalization in Japan will have a positive impact in the longer term, in our view.

To hike or not to hike? As pressure mounts on the Bank of Japan (BOJ) to raise interest rates in order to slow the yen’s decline, investors are closely watching for potential new developments in Japanese monetary policy.

The central bank only recently (on 19 March) ended eight years of negative interest rates, marking a historic step toward policy normalization. With the market being included in the new JACI Asia Pacific Index introduced last year, the BOJ’s policy actions are significant for a potentially wider group of investors.

For us at PineBridge’s Asia Fixed Income Team, the market has long been a key one in our Asia Pacific investment grade (APAC IG) investment universe. While China’s property sector crisis dominated headlines in the past few years, our earlier research on the country had led us to remain cautious on some segments within China and to diversify across the Asia Pacific region, including Japan and Australia.

The move by J.P. Morgan in March last year to introduce the JACI Asia Pacific Index into its J.P. Morgan Asia Credit family of indices further supports our approach – and our conviction that the region needs to be viewed as a whole. The new JACI Asia Pacific Index expands the coverage of the flagship J.P. Morgan Asia Credit Index (JACI Index) to also include debt from Japan, Australia, New Zealand, and other Pacific countries.

Investing in Asia Pacific blurs the traditional divide between developed markets and emerging markets, potentially posing problems for asset allocators that still look at the universe in a more traditional (and potentially outdated) way. However, we see two key benefits of doing so.

1. The addition of these markets makes for a larger and more dynamic universe.

Compared to the JACI Index, the JACI Asia Pacific Index expands the universe dramatically, from US$804 billion in market capitalization to US$1,270 billion as of 31 March 2024, and from 1,263 issues to 1,790.

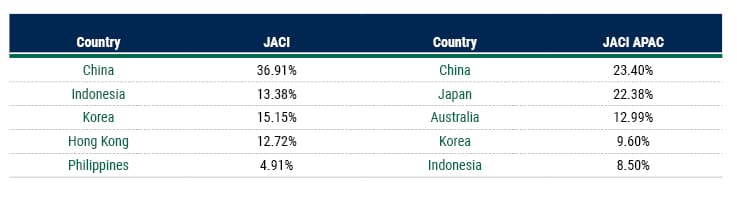

China, which takes up a large portion of JACI at 36.9%, is reduced in the JACI Asia Pacific Index to only 23.4%, making room for Australia and Japan, which together make up 35.4%.

Top 5 markets in JACI versus JACI APAC

Source: Bloomberg, JP Morgan, PineBridge Investments, as of 31 March 2024.

At the same time, the new index remains very high quality, consisting of 88.6% investment grade bonds, compared with 85.6% for the JACI.

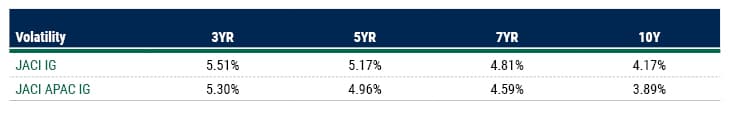

The additional markets have the net effect of dampening volatility, as shown in the table below.

Adding APAC IG Helps Reduce Volatility

Source: JP Morgan, as of 31 March 2024.

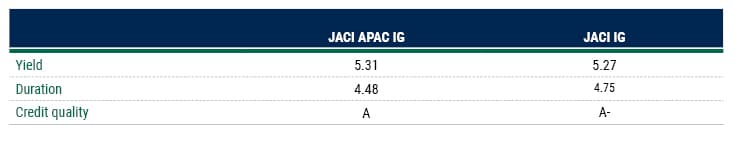

Furthermore, the JACI Asia Pacific Index offers slightly higher yield and lower duration than the JACI.

The JACI APAC Index Provides an Edge in Yield and Duration

Source: JP Morgan, as of 31 March 2024.

2. Adding APAC IG to a Global IG portfolio reduces volatility and potentially enhances returns.

For investors only invested in global investment grade bonds now, adding APAC IG to the portfolio also helps add exposure to emerging markets – but with the relative safety provided by the presence of several developed countries. Aside from Japan and Australia, these include markets classified as advanced economies by the International Monetary Fund, such as Hong Kong, South Korea, New Zealand, and Singapore.

It is also worth noting that the overlap between global IG (using as a proxy the Bloomberg Global Aggregate Corporate Index) and APAC IG is small: Australia and Japan make up only 1.7% and 2.3%, respectively, of the Global Agg Corp as of 31 March 2024.1 Investing in APAC IG therefore provides more effective exposure to the two countries.

As a cherry on top, investors not only retain the same overall credit quality – the Bloomberg Global Aggregate Corporate Index averages at A2/A3, while the average for JACI Asia Pacific Index is A3 – but also gain additional yield from adding APAC IG to the portfolio.

The attractive technicals of APAC IG (with low issuance meeting growing investor demand), generally steady fundamentals, lower duration, and lower credit-spread volatility all combine to make the asset class an attractive one. When added to an overall Global IG portfolio, they also result in a boost in returns and lower volatility, as seen below.

10-Year Annualized Volatility

Source: JP Morgan, PineBridge Investments, as of 31 March 2024 . Past performance is not indicative of future returns.

Our views on Japan

Rounding back to Japan, BOJ Governor Kazuo Ueda has emphasized a gradual approach to rate hikes, suggesting that aggressive rate increases are unlikely.

We believe any rate hike would have a marginal immediate impact, while being positive over the longer term. In Japan, we currently favor megabanks and a select number of insurance companies.

For megabanks, the valuation loss on their bond holdings resulting from policy actions should be manageable, in our view, given the low duration of their Japanese government bond holdings. They are likely to be net beneficiaries, with profits receiving a boost from the reallocation of their cash holdings to Japanese government bonds as interest rates rise. The megabanks have kept large cash balances in anticipation of this.

We believe insurers are likely to benefit, enjoying higher investment returns given higher interest rates. Most of them have been reducing holdings of foreign bonds and switching back to domestic bonds, particularly long-dated Japanese government bonds, as the local interest rate rose, a trend we expect to continue. Insurers’ exposures to loans or real estate have not changed materially, and they have also been prudent in taking risks.

Overall, we believe the gradual approach to tightening that Governor Ueda has suggested will help financial institutions manage asset risk in the higher interest-rate environment.

Given PineBridge’s decades of experience in investing in Asia Pacific, including markets such as Japan and Australia, our Asia Fixed Income Team not only has a nuanced understanding of market and sector dynamics, but also strong relationships with issuers in these markets. We believe these factors, along with our approach of seeking alpha through credit selection and duration management, will help investors to tap the best risk-adjusted opportunities in the APAC IG universe.

Disclosure

Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. It represents a general assessment of the markets at a specific time and is not a guarantee of future performance results or market movement. This material does not constitute investment, financial, legal, tax, or other advice; investment research or a product of any research department; an offer to sell, or the solicitation of an offer to purchase any security or interest in a fund; or a recommendation for any investment product or strategy. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. Views may be based on third-party data that has not been independently verified. PineBridge Investments does not approve of or endorse any republication of this material. You are solely responsible for deciding whether any investment product or strategy is appropriate for you based upon your investment goals, financial situation and tolerance for risk.

1 Source: Bloomberg.