EM Corporate Bonds Look Compelling in 2024’s Dynamic Landscape

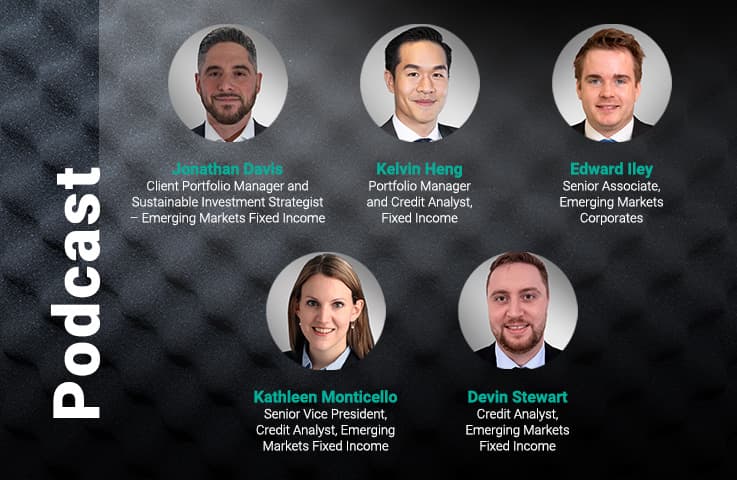

Jonathan Davis

Client Portfolio Manager and Sustainable Investment Strategist – Emerging Markets Fixed Income

The environment for credit investors remains promising as we head into the second quarter of 2024, with attractive yields, stable global growth, and anticipated Federal Reserve rate cuts supporting key markets. Among the various opportunities in fixed income, emerging market (EM) corporate debt stands out as a compelling option: not only because it provides attractive carry, but also because it stands to benefit from several tailwinds in 2024.

We believe the following dynamics will benefit EM debt investors this year.

1. A widening EM economic growth premium.

The economic growth premium of emerging over developed markets is expected to expand in 2024. Historically, as shown in the chart and table below, EM debt has thrived during periods of accelerating growth premia, presenting opportunities for investors to capture enhanced returns.

The EM/DM Growth Gap Is Set to Widen in 2024

GDP Growth (Y/Y): EM and DM

Source: IMF, World Bank as of 31 December 2023.

Average Annual Return During Years of Accelerating EM GDP Growth Premia: 2002-2023

Source: JP Morgan, Bloomberg as of 31 December 2023. Past performance is not indicative of future results.

2. Anticipated Fed rate cuts.

While the timing and magnitude of Federal Reserve rate cuts remain uncertain, EM debt has historically outperformed during periods when US rates were falling.1 The potential easing of US monetary policy could further bolster the attractiveness of EM debt investments.

EM Debt Is Likely to Benefit From Anticipated Fed Rate Cuts This Year

FOMC Dot Plot and Market Pricing

Source: Bloomberg as of 12 January 2024.

Average Annual Return During Years of Fed Rate Cuts: 2002-2023 (ex-2008)

Source: JP Morgan, Bloomberg as of 31 December 2023. Past performance is not indicative of future results.

3. Compelling risk-adjusted returns for EM corporates.

EM corporates, often overlooked, constitute the largest segment of the US dollar-denominated EM debt market, with a market cap of $2.5 trillion.2 Historically, EM corporate debt has delivered strong risk-adjusted returns,3 making it a noteworthy component of EM debt portfolios.

EM Corporates Have Shown Strong Risk-Adjusted Returns

Trailing 10 Year Annualized Returns and Volatility

Source: JP Morgan, Bloomberg as of 31 December 2023. Past performance is not indicative of future results. We are not soliciting or recommending any action based on this material. It is not possible to invest directly into an index.

4. Healthy EM corporate fundamentals.

EM corporate balance sheets are robust4 and well-positioned to weather a slowdown in global growth. This strength enhances the appeal of EM corporate debt as an investment option.

EM Corporate Leverage Compares Favorably With US Debt

IG Corporate Net Leverage Ratios: EM, US

HY Corporate Net Leverage Ratios: EM, US

Source: JP Morgan as of 31 December 2023.

5. An attractive value proposition.

EM corporate debt offers compelling value relative to similarly rated US corporates and EM sovereign debt, presenting an opportunity for investors to capitalize on favorable valuations.5

EM Corporate Spreads Look Attractive

Index Levels: EM, US

Source: JP Morgan, Bloomberg as of 12 March 2024.

All told, we believe emerging market corporate bonds offer an appealing investment proposition. EM debt could serve as a direct countermeasure to challenges that may unsettle financial markets in 2024 – and which could disproportionately affect portfolios skewed toward US or other developed market credit.

That said, some areas of emerging market debt will likely see rising risks in 2024, and investors must consider various uncertainties and risks that must be managed within portfolios.

For more of our views on emerging markets, please see our latest insights below.

2024 Emerging Market Sovereigns Outlook: Key Drivers Signal a Stronger Year

2024 Emerging Market Corporate Debt Outlook: Resilience in the Face of Global Risks

1 Source: JP Morgan, Bloomberg as of 31 December 2023.

2Source: IMF, Bloomberg, Barclays and JPMorgan as of 31 December 2023.

3 Source: JP Morgan, Bloomberg as of 31 December 2023.

4 Source: JP Morgan as of 31 December 2023.

5 Source: JP Morgan as of 30 January 2024.

Disclosure

Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. It represents a general assessment of the markets at a specific time and is not a guarantee of future performance results or market movement. This material does not constitute investment, financial, legal, tax, or other advice; investment research or a product of any research department; an offer to sell, or the solicitation of an offer to purchase any security or interest in a fund; or a recommendation for any investment product or strategy. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. Views may be based on third-party data that has not been independently verified. PineBridge Investments does not approve of or endorse any republication of this material. You are solely responsible for deciding whether any investment product or strategy is appropriate for you based upon your investment goals, financial situation and tolerance for risk.