Should CLO Investors Be Concerned About Rising LMEs?

Komal Shahzad, CFA

CLO Tranche Analyst

Jonathan Kramer, CFA

Fixed Income Product Specialist, Leveraged Finance

A liability management exercise (LME) is a path a distressed borrower may take in lieu of a traditional default or restructuring that allows sponsors and certain lenders to improve their standing at the expense of others (rather than being treated equally as with a traditional bankruptcy waterfall). This can result in so-called “lender-on-lender violence.”

While LME activity has increased and created uncertainty for lenders, it has often replaced what would otherwise have been a more typical default outcome. Therefore, we do not expect LMEs to push up overall leveraged loan default rates relative to historical levels.

We expect the overall impact of LMEs on loan and CLO returns to remain muted, and we believe CLO managers with strong investment and risk management processes, including evaluating the underlying risks within CLO portfolios, are more likely to help investors avoid asset downgrades and default losses.

An uptick in liability management exercises (LMEs) has been a critical theme in the CLO and leveraged loan markets recently, with portfolio managers and CLO tranche investors considering how best to approach risk management as LMEs continue to rise.

An LME is a path a distressed borrower may take in lieu of a traditional default or restructuring; but in an LME, instead of lenders being treated equally across the lender group and having priority as designated by the traditional bankruptcy waterfall, sponsors and certain lenders are able to improve their standing at the expense of others – so-called “lender-on-lender violence.”

Weaker documentation, alongside competition for claims on assets, has allowed both issuers and lenders to devise more creative tactics to execute LMEs. The two most common types of LMEs can typically be characterized as:

1) “Uptiering” or “priming,” in which the majority of a lender group allows for issuance of incremental debt that has a higher priority over existing debt; or

2) Dropdown transactions, in which the weaker documentation allows the borrower to transfer assets to a non-restricted subsidiary, away from the collateral package available to creditors.

Overleveraged lower-rated issuers are increasingly turning to LMEs to manage near-term debt maturities, and the use of these tactics has resulted in more uncertainty for their lenders. As a result, these issuers are experiencing much wider credit spreads relative to their higher-rated peers, similar to what has occurred during periods of broader market stress, such as during 2016 and 2020, when LMEs were uncommon (see chart).

Spreads Have Widened as LMEs Ticked Up

Source: LCD, Morningstar LSTA US Leveraged Loan Index as of 1 October 2024. STM is spread-to-maturity.

What should CLO investors be watching?

LME outcomes vary, given that each issuer and credit has distinct characteristics, so monitoring CLO managers and their risk management strategies is paramount for CLO investors. Certain vintage years and sectors may also warrant extra scrutiny, including 2021 leveraged buyout (LBO) and M&A loans with aggressive underwriting assumptions, sectors that are more sensitive to regulatory changes, and other sectors facing secular challenges, such as media and telecom, which are also broadly overleveraged.

When LMEs (essentially defaults in a different form) are factored into default rates, the par-weighted last-12-month US high yield bond and loan default rates were at 1.39% and 3.78%, respectively (as of October 20241) down 148 bps and up 51 bps since year-end 2023. This marks a 26-month low for high yield defaults, whereas loan defaults reached a 44-month high and have remained above 3% for 12 of the past 13 months. For context, the 25-year average high yield and leveraged loan default rates are 3.4% and 3.0%, respectively.2

However, while LME activity has increased, it has often replaced what would otherwise have been a more typical default outcome. Therefore, we do not expect LMEs to push up overall leveraged loan default rates relative to historical levels. The 2024 default forecasts for high yield bonds and leveraged loans are around 1.25% and 3.75%, respectively, including LMEs/distressed exchanges.3 However, individual managers’ outcomes are diverging due to the unequal treatment of lenders in an LME.

Sales of Distressed Loans by US CLO Managers Over Time

Source: Citigroup Global Markets Inc. as of 7 October 2024.

While heightened LMEs in the loan market may pose challenges to CLO portfolio managers, the ability to remain nimble and proactively manage risk has resulted in lower defaults within CLO portfolios (both including and excluding distressed exchanges) than in the broader loan market (see next chart). We have also seen a record amount of loan resets in CLOs, which can enable derisking in distressed names given that resets often require a reduction in exposure to such loans and optimization of CCC exposure. Active trades reduced CCC exposure by 2.4% over the past 12 months.4

In addition to active management of risk in CLOs, the robustness of the CLO structure – which includes passing CCC tests, overcollateralization (OC) tests, and other collateral quality tests – allows for lower default rates compared with the broader loan market.

CLO Defaults Remain Lower Than for the Broader Loan Market

Sources: BofA Global Research, “CLO Loan Defaults,” Intex, Bloomberg, Markit as of 30 September 2024.

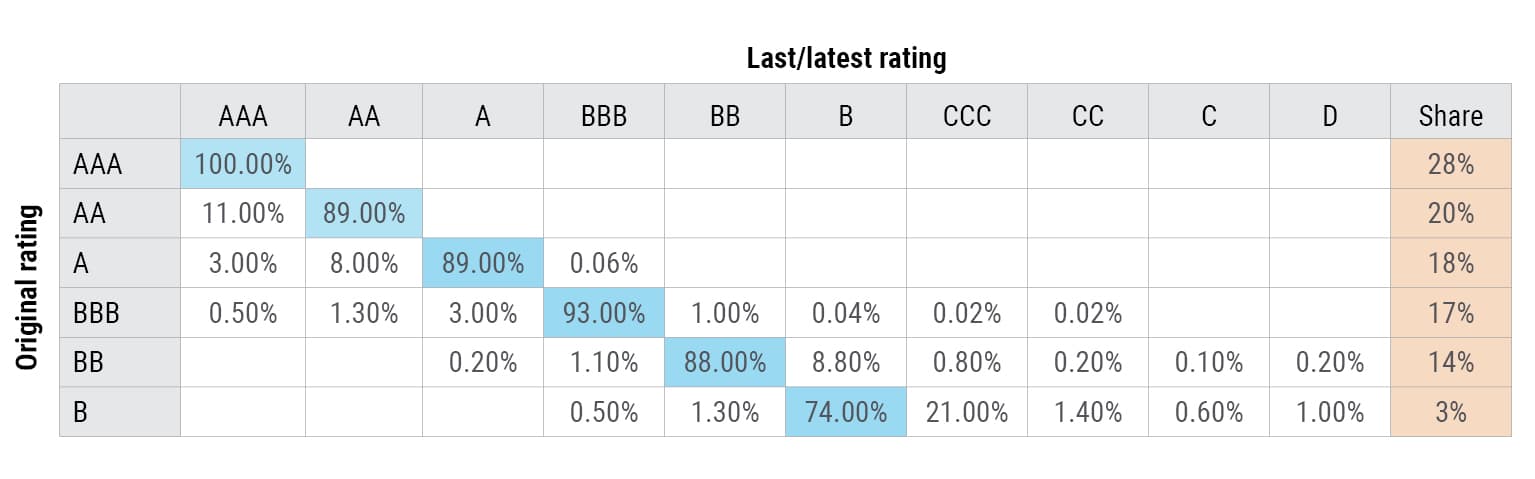

BSL 2.0 CLO Rating Transitions

Source: BofA Global Research, CLO Weekly, 23 August 2024.

LMEs’ impact on CLOs should remain muted

While LME activity is elevated, active management of CLOs may help CLO tranche investors avoid potential worst-case outcomes. Historically, BB and B rated CLO tranche impairment rates have totaled 0.7% and 3.5%, respectively, compared with 16.2% and 31.6% (average 10-year) for BB and B rated corporate loans.5 In our experience, manager selection and deal selection remain key to ensuring best-case outcomes.

In the face of increased LME activity, we believe managers with strong investment and risk management processes, including evaluating the underlying risks within CLO portfolios, are more likely to help investors avoid asset downgrades and default losses. We believe a diligent credit underwriting and investment process, as the basis of a robust bottom-up re-underwriting of CLO portfolios, allows for this level of risk management and differentiates a successful CLO manager’s security selection process from that of a securitization team.

In many ways, an LME represents a default in a different form, and we do not expect overall default rates to increase relative to historical levels. While manager selection can help keep defaults down and losses low, the overall negative impact of LMEs on loan and CLO returns is expected to remain muted.

Disclosure

Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. It represents a general assessment of the markets at a specific time and is not a guarantee of future performance results or market movement. This material does not constitute investment, financial, legal, tax, or other advice; investment research or a product of any research department; an offer to sell, or the solicitation of an offer to purchase any security or interest in a fund; or a recommendation for any investment product or strategy. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. Views may be based on third-party data that has not been independently verified. PineBridge Investments does not approve of or endorse any republication of this material. You are solely responsible for deciding whether any investment product or strategy is appropriate for you based upon your investment goals, financial situation and tolerance for risk.