Swiss Sustainable Investment Market Study 2022

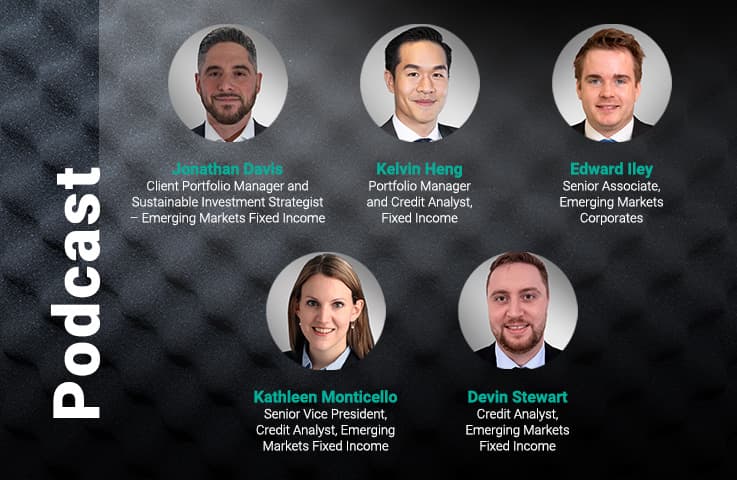

Jonathan Davis

Client Portfolio Manager and Sustainable Investment Strategist – Emerging Markets Fixed Income

PineBridge is delighted to have been selected to contribute to the Swiss Sustainable Investment Market Study 2022!

The Swiss Sustainable Investment Market Study 2022 published by Swiss Sustainable Finance (SSF) is recognised as a reliable barometer for the Swiss financial industry for tracking the acceptance and popularity of sustainable investments.

Decarbonizing the World: The three must-haves to achieve environmental and financial sustainability

The decarbonization of our planet is vital to its sustainability, and the coordinated commitment of governments, financiers, and corporate entities toward that goal is essential to its success. In our role as asset managers, we have a responsibility to contribute to environmental sustainability efforts and a responsibility to ensure that our clients’ portfolios are positioned for financial sustainability as well.

At PineBridge, we have a history of focusing on alpha generation through bottom-up credit analysis and security selection. With so much of this story yet to be written, we have identified three must-have attributes within our ESG framework that will enable our investments to both promote decarbonization and to profit from it.

First, we find it essential to prioritize an integrated, forward-looking ESG trend within our analysis of ESG risk.

Second, we must be prepared to look to the future and not necessarily exclude exposure to carbon, but rather to include exposure to entities that are moving toward lower-carbon processes.

Third, we must maintain an engagement framework to identify and encourage issuers to make investments in green technology – investments that will make their business models not only more sustainable, but also more profitable in the carbon-neutral world of the future.

Finally, we believe it is vital for investment managers to maintain a formal engagement framework, that will not only set a standard for the way in which we engage management teams on ESG issues across industries, but also provide metrics for how those engagements have impacted corporate behavior.

Read the full blog Decarbonizing the World: The Key Role of Asset Owners and Managers

Access the 2022 edition of the Swiss Sustainable Investment Market Study 2022

Disclosure

Investing involves risk, including possible loss of principal. The information presented herein is for illustrative purposes only and should not be considered reflective of any particular security, strategy, or investment product. It represents a general assessment of the markets at a specific time and is not a guarantee of future performance results or market movement. This material does not constitute investment, financial, legal, tax, or other advice; investment research or a product of any research department; an offer to sell, or the solicitation of an offer to purchase any security or interest in a fund; or a recommendation for any investment product or strategy. PineBridge Investments is not soliciting or recommending any action based on information in this document. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author, may differ from the views or opinions expressed by other areas of PineBridge Investments, and are only for general informational purposes as of the date indicated. Views may be based on third-party data that has not been independently verified. PineBridge Investments does not approve of or endorse any republication of this material. You are solely responsible for deciding whether any investment product or strategy is appropriate for you based upon your investment goals, financial situation and tolerance for risk.